how does the arizona charitable tax credit work

Get Your Max Refund Today. With this kind of program it is now easier to donate money to a qualified charitable organization in helping many communities like in the state of Arizona.

Arizona Charitable Tax Credit Donations St Mary S Food Bank

How Does a Business Get Started on Arizona Tax Credit The federal government of America created an effective program for tax reduction that benefited many businesses and individuals already.

. Uses Tax Credit Form 321. Thanks to the Arizona Charitable Tax Credit you can donate up to 800 and get it right back on your Arizona tax return. The Charitable Tax Credit applies only on your Arizona State income tax.

Qualifying Charitable Organization Tax Credit single filers maximum gift 400 and married filers up to 800. With the Arizona Charitable Tax Credit you can donate up to 800 to St. Donating to tax credit eligible organizations will most likely leave you in a tax neutral situation meaning youll pay about the same total amount whether you use the tax credits or just pay the tax.

Any amount claimed as a tax credit cannot be taken as an itemized deduction on your Arizona return. Marys Food Bank will provide food to hungry children in Arizona. Make a difference in the lives of people with disabilities and reduce your Arizona State Income tax.

How does it work. For a single taxpayers or heads of household the maximum credit is 400. Maximize Your Tax Deductions And Credits When You File With TurboTax.

Ad Free For Simple Tax Returns Only With TurboTax Free Edition. To learn more about charitable contributions in general visit these IRS resources. 2 Ways 2 Give.

Contributions can be accepted through April 18th for a credit in the previous calendar year. Marys Food Bank and get all of it back in your Arizona Tax Refund. Please consider taking advantage of this credit by making a donation to Harvest Compassion Center PhoenixMitchell Swaback Charities Inc.

If you earned 40000 a tax credit policy means that with a 3 tax rate you would owe 1200 in taxes. How the Arizona Tax Credit Works. Tax Topic 506 -Charitable Contributions.

You can also get a tax break for making donations to a qualified charitable organization or foster care organization or to the Arizona Military Family Relief Fund which provides financial. Contribute the maximum allowable for your filing status or your total liability whichever is less. You may contribute to AZTO online or by mail with a current year Donation Form to participate in the tax credit program.

You are able to control how your Arizona Tax dollars are spent. Make a Charitable Donation to St. The Arizona Charitable Tax Credit permits any credits for contributions to Qualified Charitable Organizations QCOs and Qualifying Foster Care Charitable Organizations QFCOs that are not applied against tax obligations for the most recent taxable year to be carried forward for a period of five consecutive years.

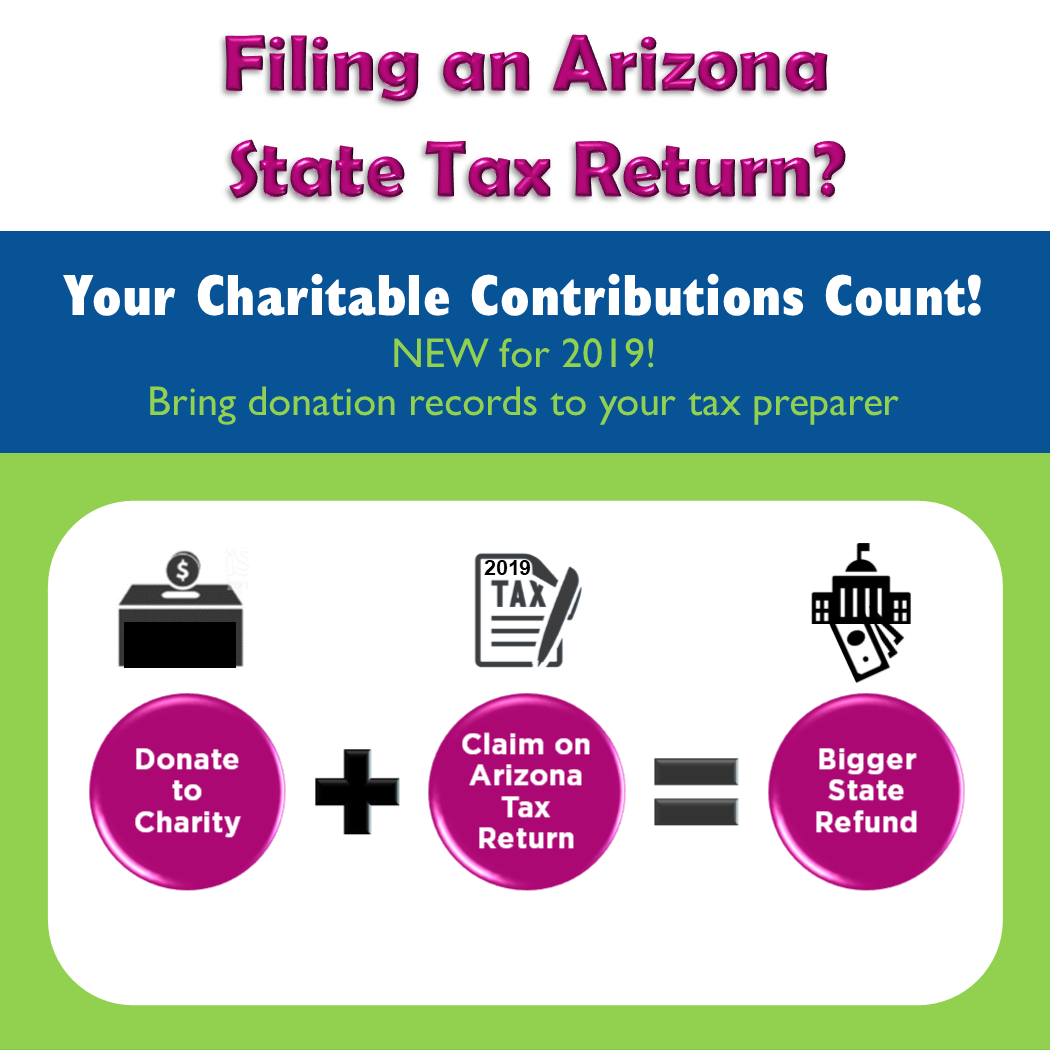

Marys with the Arizona Charitable Tax Credit Your charitable donation of up to 800 to St. Individuals making cash donations made to these charities may claim these tax credits on their Arizona Personal Income Tax returns. When you file your Arizona taxes you can claim a dollar-for-dollar Arizona Charitable Tax Credit that will either reduce your tax liability or increase your refund.

However you may claim the Arizona Charitable Tax Credit on your state return and an itemized deduction for the amount of the contribution on the federal return. Contributions for the 2021 tax year can be made through April 18th 2022. A tax credit is a better deal and this is how Arizonas charitable tax credit policy works.

However you may be able to claim a federal tax deduction for the amount donated. Please note On Thursday August 23 2018 the IRS proposed amendments to federal tax code regulations that may change how State tax credit donations are treated on your federal tax. Contributions to Qualifying Charitable Organizations Contributions to Qualifying Foster Care Charitable Organizations.

When you file your Arizona taxes you can claim a dollar-for-dollar Arizona Charitable Tax Credit that will either reduce your tax liability or increase your refund. Maximum contributions are 400 for filing single or 800 for filing jointly. How do I document my contribution.

You can make a donation to Phoenix Rescue Mission of any amount up to 400 if filing singly or 800 if filing jointly for your Arizona state tax return. Claim a Private School Tax Credit on your AZ tax return by using forms 301 323 and 348. The Arizona Charitable Tax Credit was created to help taxpayers support charities that offer services to low-income residents with chronic illnesses or disabilities.

You can make a gift of either 400 if you file taxes as single and head of household or as married filing separate or 800 as married filing joint to Linkages and at the same time reduce your tax liability to the State of Arizona by that amount. And in return you will receive a dollar-for-dollar tax credit for 400 filing single or 800 filing jointly. The state of Arizona provides an incredible incentive for taxpayers who donate to certain qualifying charities like St.

Does the tax credit also apply to my federal income tax returns. But since you donated 400 to Flagstaff Shelter Services and 500 to a foster care organization you can subtract that from the 1200 tax bill so you only owe 300 in taxes. The efforts of this coalition of charities.

For cash and credit card donations you will receive a receipt from Phoenix Childrens Hospital. Please note that AWSF is able to accept donations in any amount but tax credits can only be provided up to the above stated amounts. Arizona Charitable Tax Credit.

Beginning in 2016 the amount of this credit is 800 for married taxpayers filing jointly. Your donation to the QCO tax credit will support organizations assisting low-income children individuals and families. Arizona law provides an income tax credit for cash contributions made to certain charities that provide help to the working poor.

Arizona Charitable Tax Credit Arizona law allows taxpayers to redirect some of their state taxes to help the poorest in our state. However you may still claim any excess over the amount claimed as a credit as an itemized deduction for Arizona. The Arizona State Tax Credit program allows you to make a donation to an eligible organization and receive a dollar-for-dollar credit against Arizona state taxes owed.

Home Borderlands Food Waste Recycling Food Waste Composting Food

Arizona Charity Donation Tax Credit Guide Give Local Keep Local

Arizona Charity Donation Tax Credit Guide Give Local Keep Local

Great News Visionquest 20 20 Qualifies As An Az Tax Credit Donation Helping More Children Is Even E Charitable Organizations Tax Credits Social Security Card

Celebrating Breastfeeding Month Noah Health Center Breastfeeding Emotional Wellness Health Education

Our Expert Staff Members Trevor Ainardi Rebecca Montoya Alex Tkatchov Christine Beck Are Very Well Known For Accounting Services Accounting Tax Preparation

Spring Cleaning We Re Taking Donations For Our Rummage Sale Saturday March 8 All Proceeds Benefit Our Dignity Progr Rummage Sale Donation Drop Off Rummage

The 2022 Definitive Guide To The Arizona Charitable Tax Credit Phoenix Childrens Hospital Foundation

Camp Wildcat The University Of Arizona Tucson Az Student Volunteer University Of Arizona University Of Arizona Tucson

Qualified Charitable Organizations Az Tax Credit Funds

St Mary S Food Bank Feeding The Hungry In Arizona Since 1967 Food Food Bank Hungry

Will You Partner With Us To Help Those In Need Outreach The Neighbourhood Giving Tuesday

The 2022 Definitive Guide To The Arizona Charitable Tax Credit Phoenix Childrens Hospital Foundation

Certification For Qcos And Qfcos Arizona Department Of Revenue

The 2022 Definitive Guide To The Arizona Charitable Tax Credit Phoenix Childrens Hospital Foundation

You Should Too Sport Team Logos Team Logo Allianz Logo

Charitable Contributions Count In Arizona Tempe Community Council