proposed estate tax changes october 2021

The 117M per person gift and estate tax exemption will remain in place and will be increased annually for inflation until its already scheduled to sunset at the end of 2025. As of 2021 the exemption stands at 11700000 per person and is expected to increase each year based upon the US.

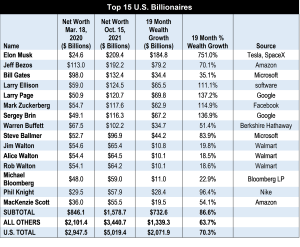

Updates Billionaire Wealth U S Job Losses And Pandemic Profiteers Inequality Org

Taxpayers who are considering substantial gifts or similar planning today.

. One other concern of this tax is that it is based on deferred gain and not net worth. A proposed surtax of 5 on MAGI of non-grantor trusts over 200000. Estate Gift and GST Tax Exemptions.

This amount will be indexed for inflation. What was considered a tax-free gift on December 31 2021 now becomes a taxable gift and incurs gift tax of 2565000. July 13 2021.

State death taxes paid are deductible from the federal gross estate for estate tax purposes. The current 2021 gift and estate tax exemption is 117 million for each US. The Sanders proposal had provided for a 1 million gift tax exemption and a 35 million exemption for estate and GST tax purposes.

Enacted in the Tax Cuts and Jobs Act TCJA. Key proposals in the estate planning realm that have been. Bureau of Labor Statistics Consumer Price Index.

The exemption will increase with inflation to approximately 12060000 per person in 2022. Doubling of the exemption and inflation. Under the proposal this would be reduced to approximately 6000000.

The House budget reconciliation bill HR. Together with the transfer tax the net worth of this estate would be reduced by almost 40 by the two taxes. Current Transfer Tax Laws.

The House proposal accelerates the 2026 reduction to 2022 and. Act BBBA The Build Back Better Act BBBA. The proposed impact will effectively increase estate and gift tax liability significantly.

The federal gift estate and generation-skipping transfer GST tax exemptions that is the amount an individual can transfer free of any of these taxes are 117. The Biden Administration has proposed significant changes to the income tax system. The proposed law would reduce the federal gift and estate tax exemption from the current 10 million exemption indexed for inflation to 117 million for 2021 to 5 million indexed for inflation to roughly 62 million as of January 1 2022.

Federal estate and gift tax are assessed at a flat rate of 40. PROPOSED ESTATE AND GIFT TAX LAW CHANGES OCTOBER 2021. No Changes to the Current Gift and Estate Exemption Provisions Until 2025.

That amount is annually adjusted for inflationfor 2021 its 117 million. The tax reform proposals announced by the Administration in April and the General Explanations of the Administrations Fiscal Year 2022 Revenue. Both the Bernie Sanders proposed legislation and the September 13 th House of Representatives Ways and Means Committee bills would have drastically reduced the 11700000 per person estate and.

Married couples may give up to 23400000. Revise the estate and gift tax and treatment of trusts. The exemption is unlimited on bequests to a surviving spouse.

Amount of each estate 5 million in 2011 indexed for inflation is exempted from taxation by the. With indexation the value was 549 million in 2017 and with the temporary. Then the gift and estate tax exemption is lowered from 117 million to 6 million with the gift and estate tax rate increased from 40 to 45 all effective January 1 2022.

Lower Gift and Estate Exemptions. Would eliminate the temporary increase in exemptions. Under current law the estate tax on a net taxable estate of 11700000 will be zero.

After 2025 with the reduction in the estate tax exclusion this owners estate would owe 1715334 in estate taxes. The Biden Administration has proposed sweeping estate tax impacts to the estate and gift structure. Oregon Supreme Court upholds including out-of-state QTIP trust in surviving spouses estate In.

For nearly a year various proposals and so-called frameworks have been debated in Congress regarding. While there is still a lot of uncertainty at this point we do know that big changes are on the horizon. The TCJA doubled the gift and estate tax exemption to 10 million through 2025.

Extension of Net Investment Income Tax to Certain Business Income Other Items Not Included in This Proposed Legislation. An estate tax would never make a farm insolvent owe more in. An additional surtax of 3 on MAGI of non-grantor trusts over 500000 bringing the total surtax on these trusts to 8.

Bidens Tax Proposals And Estate Planning. The proposals reduce the federal estate and gift tax exemption from the current 117 million inflation-adjusted for 2021 to 5 million inflation-adjusted. The BBBA would return the exemption to its pre-TCJA limit of 5 million in 2022.

Under current law the existing 10 million exemption would revert back to the 5 million exemption amount on January 1 2026. The Biden campaign is proposing to reduce the estate tax exemption to 3500000 per person. The Wealth Advisor Contributor.

The House Ways and Means Committee released its tax law proposal the House Proposal to be incorporated in a budget reconciliation bill on Monday September 13 2021. The proposal reduces current estate gift and generation-skipping transfer GST exemptions in half. If enacted the Bill would among other things.

5376 the Bill proposes sweeping changes to tax rules that apply to individuals and trusts with far-reaching implications for estate planning. Under current law the 2022 exemption is estimated to be around 12000000. Lothes Sep 24 2021.

Eliminate estate and gift tax valuation discounts on interests in nonbusiness entities. Friday October 29 2021. The House Proposal if enacted in its present form could have a significant and adverse impact on estate planning and result in increased exposure to federal estate and gift taxes.

Tax Changes for Estates and Trusts in the Build Back Better.

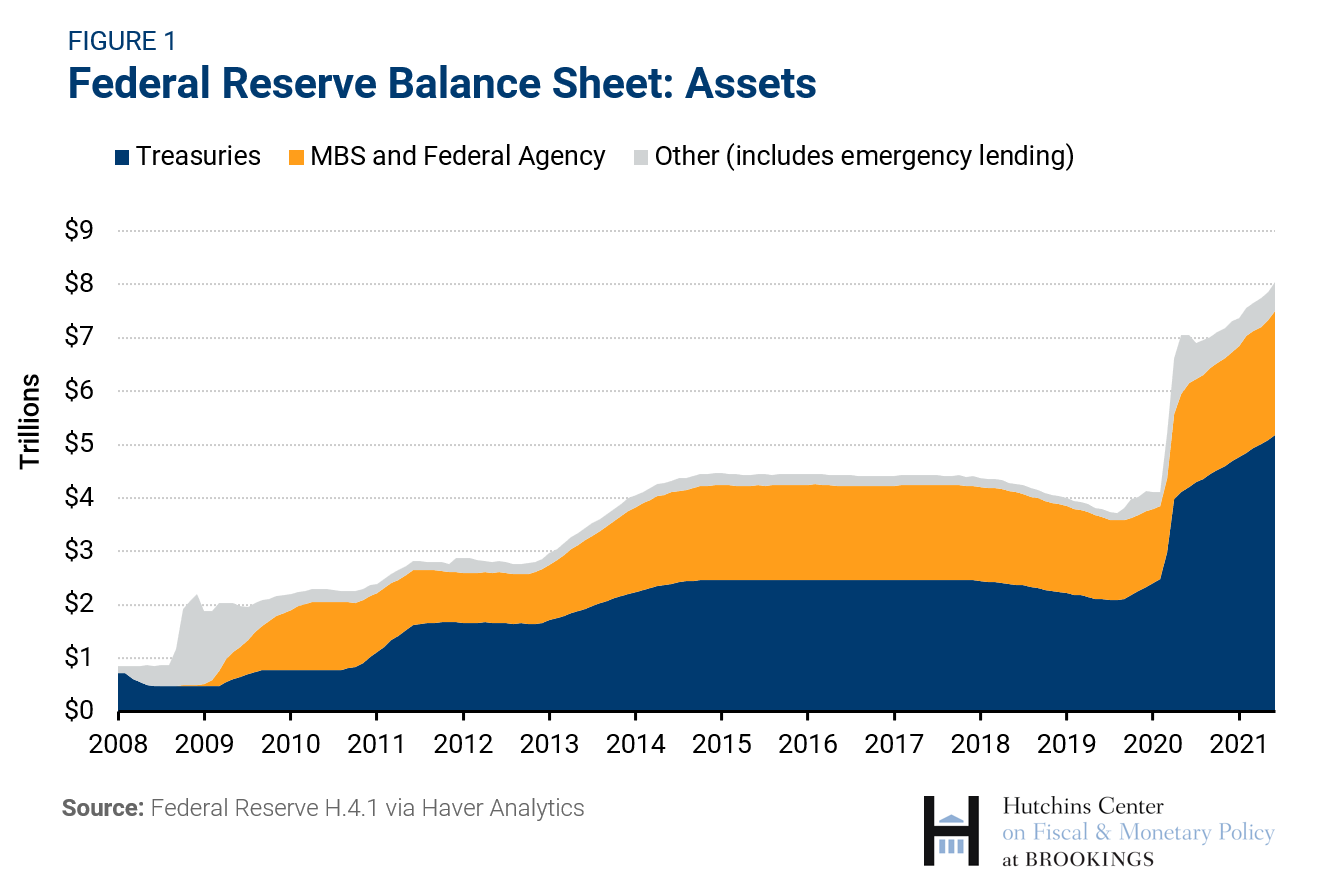

What Does The Federal Reserve Mean When It Talks About Tapering

Quits Big Raises And Severe Labor Shortages The U S Jobs Market In 2021 The Washington Post

Us Interest Rates Farmdoc Daily

Why To Consider Stock Volume Fidelity

Have 3 000 Buying These 2 Stocks Would Be The Smartest Move You Ever Made The Motley Fool The Motley Fool Intuitive Surgical Magnetic Resonance Imaging

Wall St Edges Up As Payrolls Report Keeps Fed On Track In 2022 Payroll Wall Edges

Most Americans Are Ditching Traditional New Year S Resolutions For 2021 Survey Finds December Holiday Gift Guide Home Improvement

Secured Property Taxes Treasurer Tax Collector

Tax Law Changes 2021 Loss Limitation Rules Becker

Tax Updates Rr 17 2021 Extension Of Estate Tax Amnesty Rmc 94 2021 And Rmc 97 2021 Estate Tax Social Media Influencer Social Media

Updates Billionaire Wealth U S Job Losses And Pandemic Profiteers Inequality Org

China Economic Update December 2021

The Sectors Most Impacted By Workers Quitting Jobs In The Great Recession The Washington Post

Real Estate Market Forecast For 2021 Graphing Sale House Distressed Property

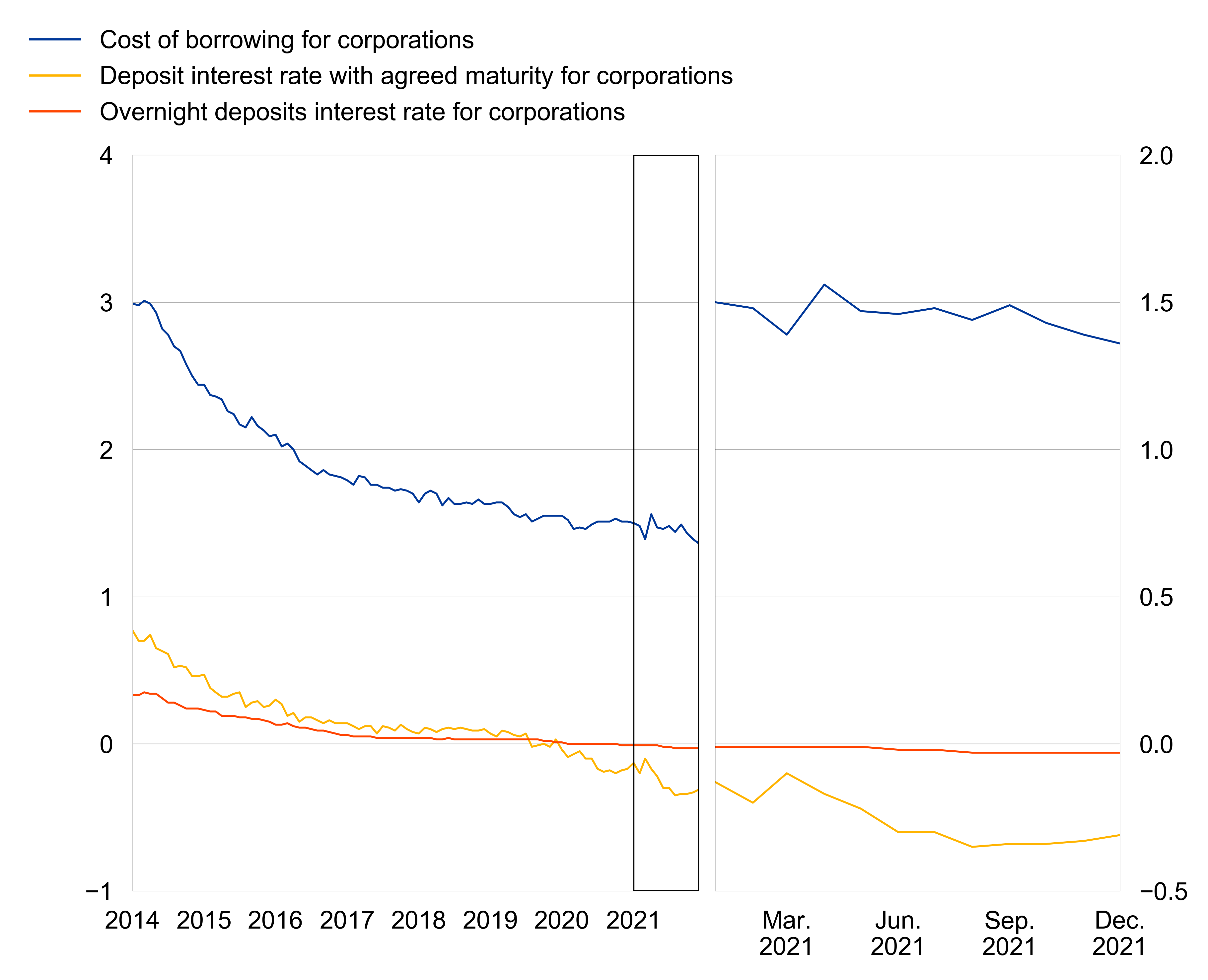

Euro Area Bank Interest Rate Statistics December 2021

Global Financial Stability Report October 2021 Covid 19 Crypto And Climate Navigating Challenging Transitions Imfsg