vermont state tax brackets

68 on taxable income between. Those earning between 13900 and 215400 are subject to marginal tax.

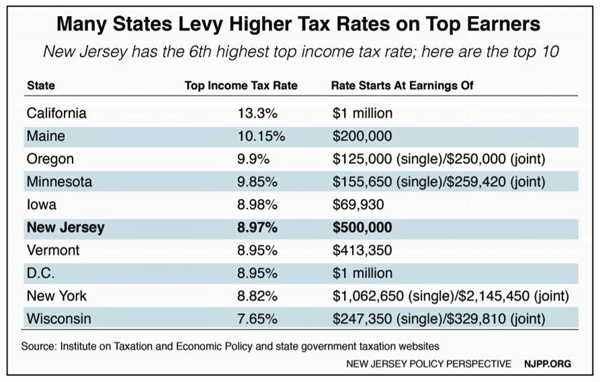

The Provocative Millionaire S Tax Its Potential And Past In N J Whyy

Any income over 204000 and 248350 for.

. Before sharing sensitive information make sure youre on a state government site. Please wait at least three days before checking the status of your return on electronically filed returns and six. 5 rows 2022 Vermont State Tax Tables.

Vermont state income tax rate table for the 2020 - 2021 filing season has four income tax. The Vermont State Tax Tables for 2023 displayed on this page are provided in support of the 2023 US Tax Calculator and the dedicated 2023 Vermont State Tax CalculatorWe also provide. The site is secure.

4 rows Vermont has four marginal tax brackets ranging from 335 the lowest Vermont tax. The site is secure. Local Option Meals and Rooms Tax.

9 Vermont Meals Rooms Tax Schedule. Local Option Alcoholic Beverage Tax. Before sharing sensitive information make sure youre on a state government site.

The latest Vermont state income tax brackets table for the Married Filing Jointly filing status is shown in the table below. 6 Vermont Sales Tax Schedule. State government websites often end in gov or mil.

Before sharing sensitive information make sure youre on a state government site. Tax Bracket Tax Rate. Any sales tax that is collected belongs to the state and does.

It ranges from 335 to 875. Vermont has an individual income tax. Vermont Income Taxes.

5 rows The Vermont income tax has four tax brackets with a maximum marginal income tax of 875. Vermont has a graduated individual income tax with rates ranging from 335 percent to 875 percent. Vermont has four tax brackets for the 2021 tax year which is a change from previous years when there were five brackets.

Rates range from 335 to. The state income tax rate in Vermont is progressive and ranges from 335 to 875 while federal income tax rates range from 10 to 37 depending on your income. Vermont also has a 600 percent to 85 percent corporate income tax rate.

The site is secure. Vermont Tax Brackets for Tax Year 2022. These income tax brackets and rates apply to.

355 on the first 37450 of taxable income. Like most states with income tax it is calculated on a marginal scale with four 4 tax brackets. The Vermont State Tax Tables for 2022 displayed on this page are.

State government websites often end in gov or mil. Sales tax or use tax is any tax thats imposed by the government for the purchase of goods or services in the state of Vermont. State government websites often end in gov or mil.

Vermonts income tax rates are assessed over 5 tax brackets. Any taxable income exceeding 25 million is subject to the top marginal rate of 109 percent. As you can see your Vermont income is taxed at different rates within the given tax brackets.

Vermont Income Tax Vt State Tax Calculator Community Tax

Vermont Sales Tax Calculator And Local Rates 2021 Wise

Free Vermont Payroll Calculator 2022 Vt Tax Rates Onpay

States With The Highest Lowest Tax Rates

Utah Income Tax Rate And Brackets 2019

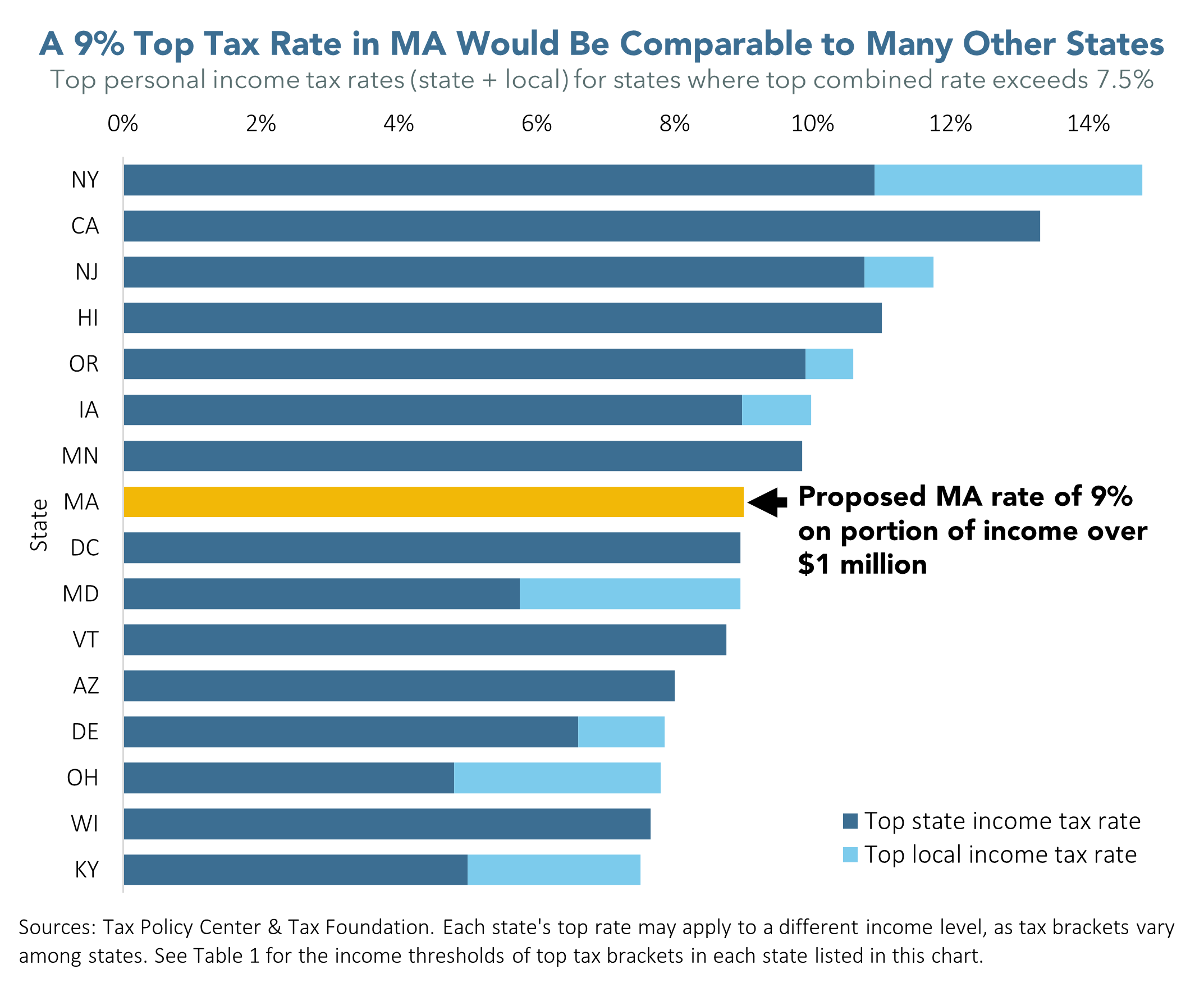

With Millionaire Tax Massachusetts Top Tax Rate Would Compare Well To Top Rates In Other States Mass Budget And Policy Center

Vermont Corporate Income Tax Rate 12th Highest Vermont Business Magazine

Effective State Income Tax Map Public Assets Institute

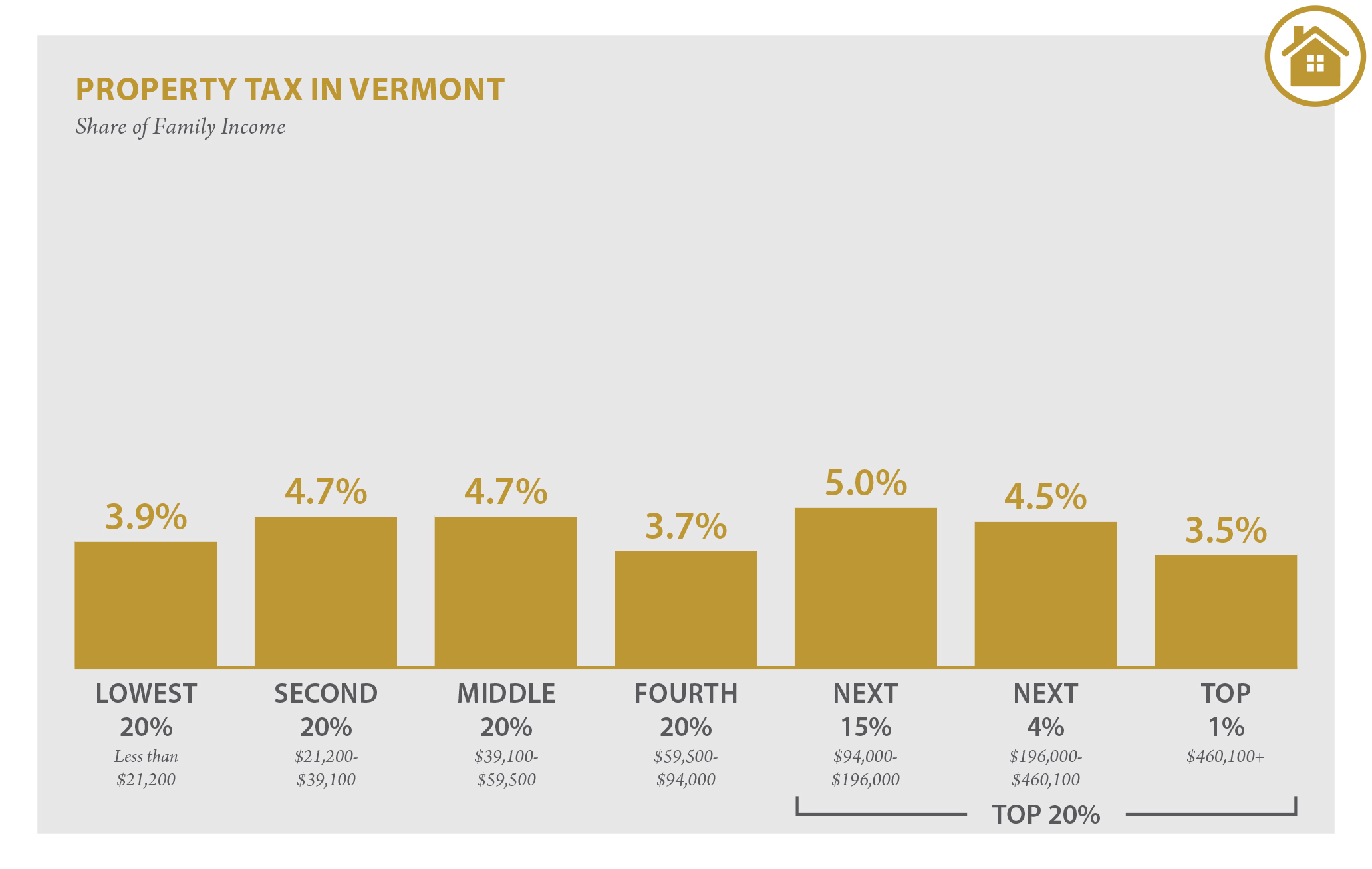

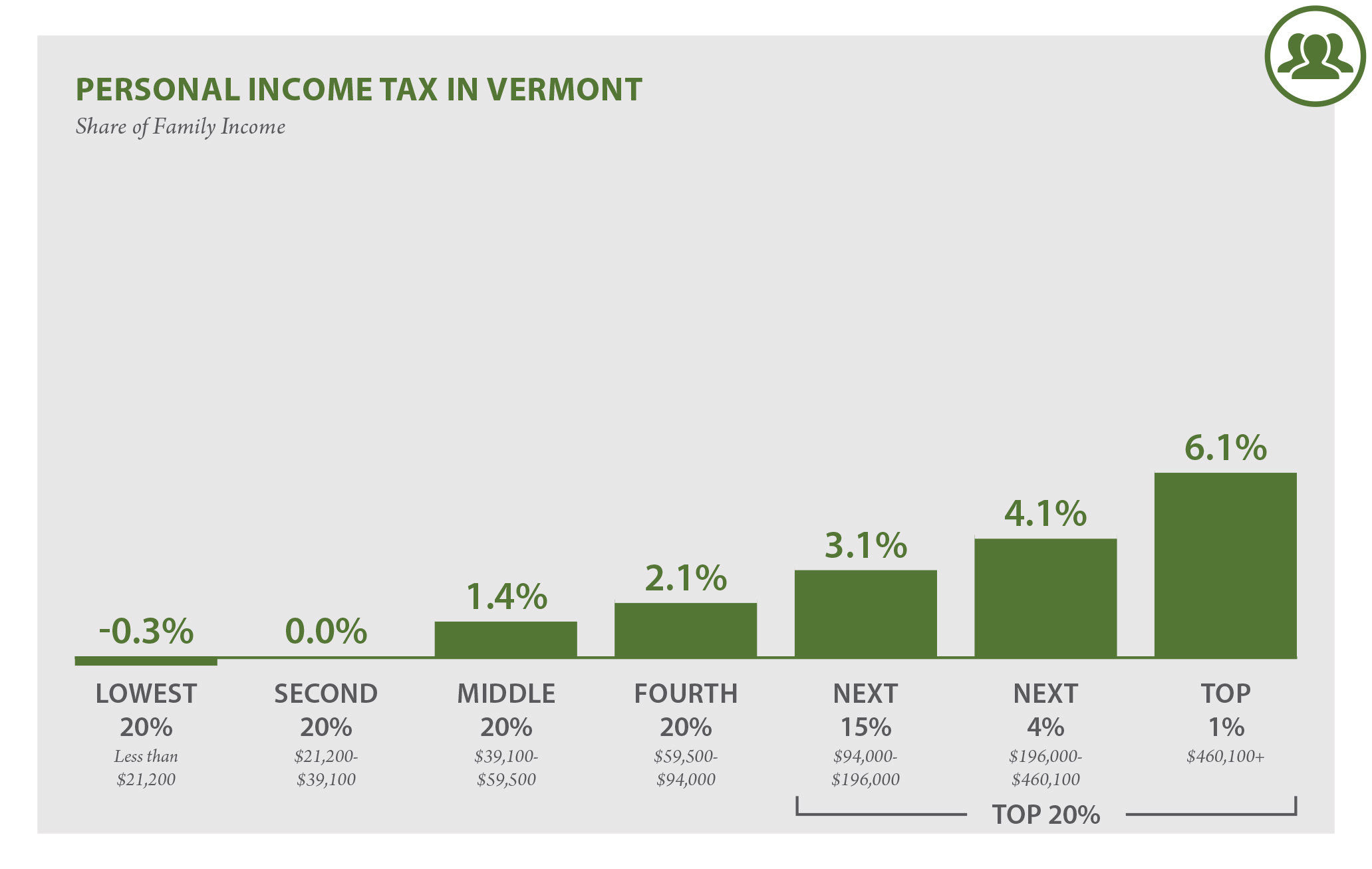

Vermont Who Pays 6th Edition Itep

Fy 2020 Tax Structure Explained Winners And Losers Vermont Business Magazine

Capital Gain Tax Rates By State 2021 2022 Calculate Cap Gains

Vt Dept Of Taxes Vtdepttaxes Twitter

Lowest Highest Taxed States H R Block Blog

Vermont Estate Tax Everything You Need To Know Smartasset

State Income Taxes Highest Lowest Where They Aren T Collected

Vermont Tax Rates Rankings Vermont State Taxes Tax Foundation

Vermont Has The Capacity To Avoid 2016 Budget Cuts Public Assets Institute

Vermont Who Pays 6th Edition Itep

State Corporate Income Tax Rates And Brackets Tax Foundation